What We Delivered – A

Comprehensive AI Solution Suite

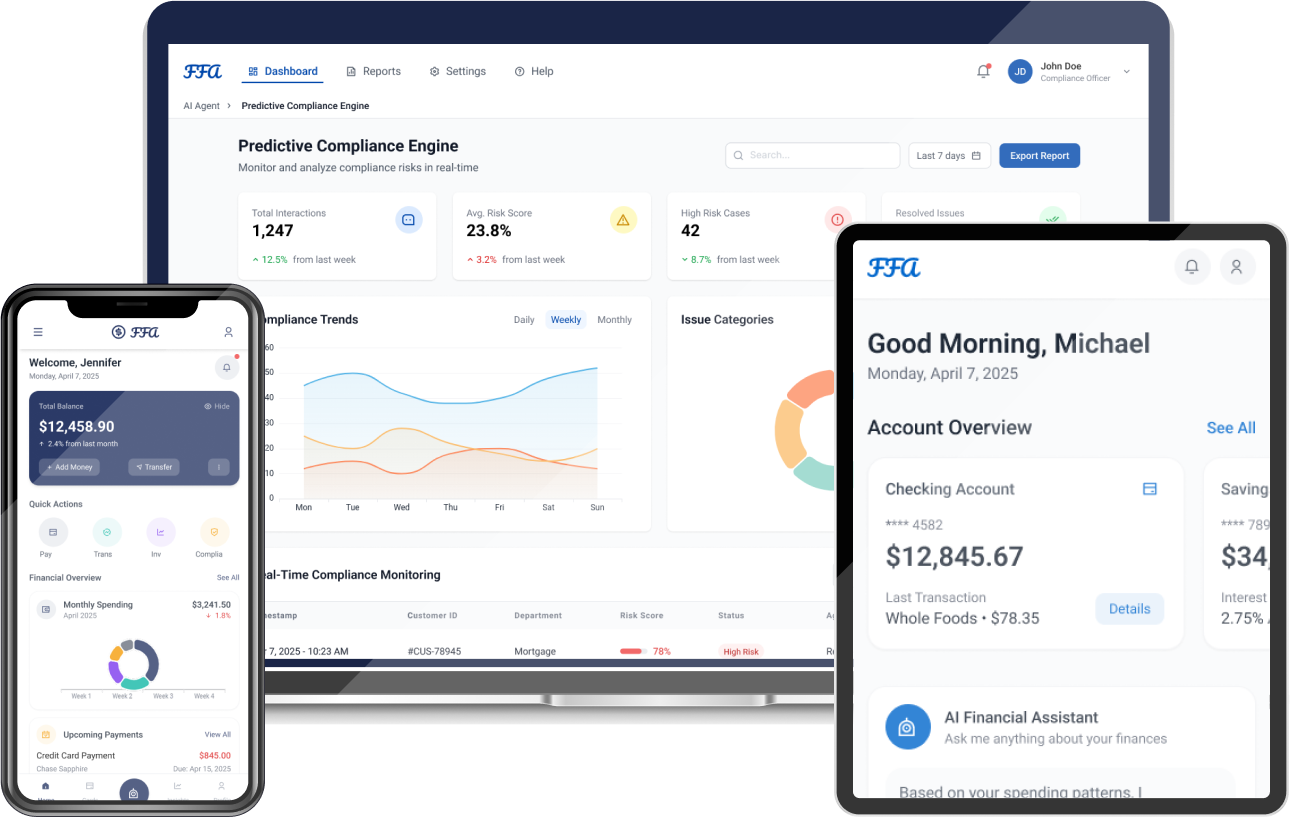

To address First Financial Agency's complex requirements,

we developed an integrated AI-Powered ecosystem.

Neural Conversation Analytics

Machine learning engine extracts key insights for automated documentation generation

Predictive Compliance Engine

NLP-based monitoring system with deep learning risk assessment algorithms

Cognitive Assistance Platform

Real-time conversational AI delivering contextual prompts from trained models

Predictive Performance Insights

Advanced ML analytics transforming conversation data into actionable strategic intelligence