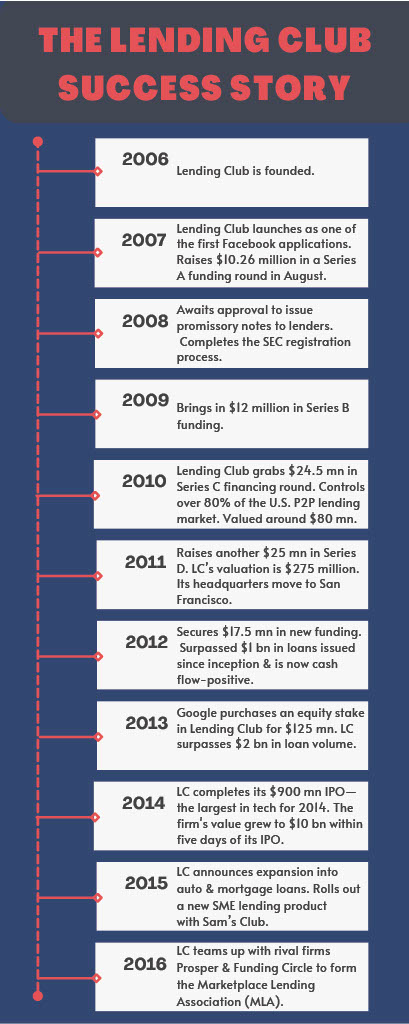

The web and mobile-based P2P lending app LendingClub has been around since 2007. Available for both iOS and Android users, it makes borrowing, investing, and managing financial portfolios a whole lot easier.

Table of Content

It essentially focuses on four types of loans: auto refinancing, business, personal, and medical loans. To date, over four million members are registered on the app. Further, the club has given out over $50B worth of loans.

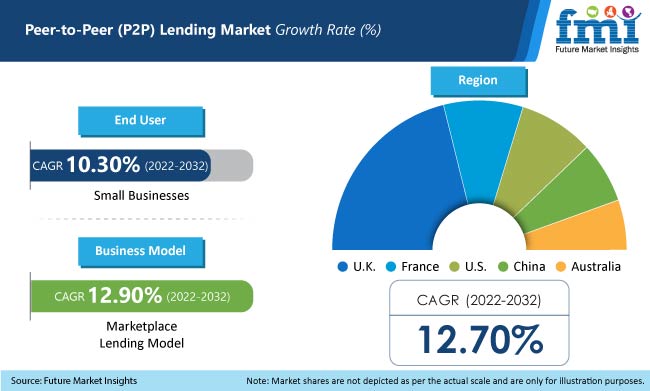

As of 2022, the market is estimated at US$ 407.2 bn, up from US$ 274.4 bn in 2021.

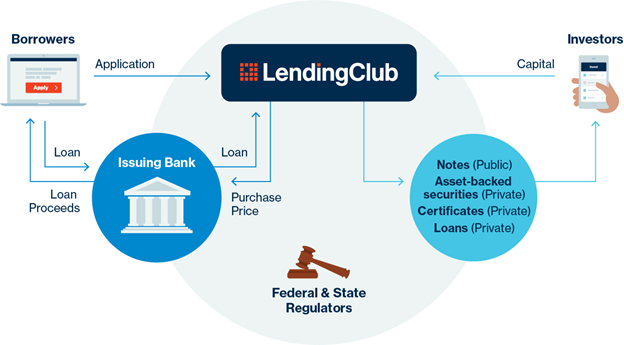

The LendingClub assesses applicants’ risk & lets investors directly lend to individuals. Investors also have the option to spread their money across several loans.

Borrowers charge an origination fee of 1% to 5% (depending on credit risk) and creditors charge a service fee that is equal to 1% of the loan amount.

An investor decides whether or not to lend the money to a borrower(s). The decision is based on the LendingClub grade (calculated using credit and income data) assigned to every approved borrower.

The borrower’s credit and income data also helps the lender determine the rate of interest. Once approved, the loan amount arrives in the borrower’s bank account in about 7 days.

There’s a monthly repayment schedule that extends over three to five years (36 to 60 monthly payments).

Source: United States Securities and Exchange Commission

LendingClub loans are generally pursued by borrowers with good-to-excellent credit (scores average 700) & a low debt-to-income ratio (average is 12%).

Borrowers can file a joint application for a larger loan line. The loan gets sanctioned because of multiple incomes.

Before you get to action, make sure that all legal concerns and financial permissions are well taken care of.

So, you’ll need some funds to operate before the investor money kicks in.

There are primarily, three ways:

If you want to work with cryptocurrency, an ICO will help you raise funds. But if you prefer traditional financial securities, launch an IPO. Then sell your stock to secure the investments.

You can create a business plan & a pitch deck to attract the attention of VC funds. Once they agree to invest in your business, you would either have to give them a share or pay a fixed amount with the agreed interest.

Many banks credit several business ventures. But you would need to select the bank that will store your operational capital for P2P lending.

Like any other marketplace, the person-to-person lending platform is divided into two sections: borrowing and lending.

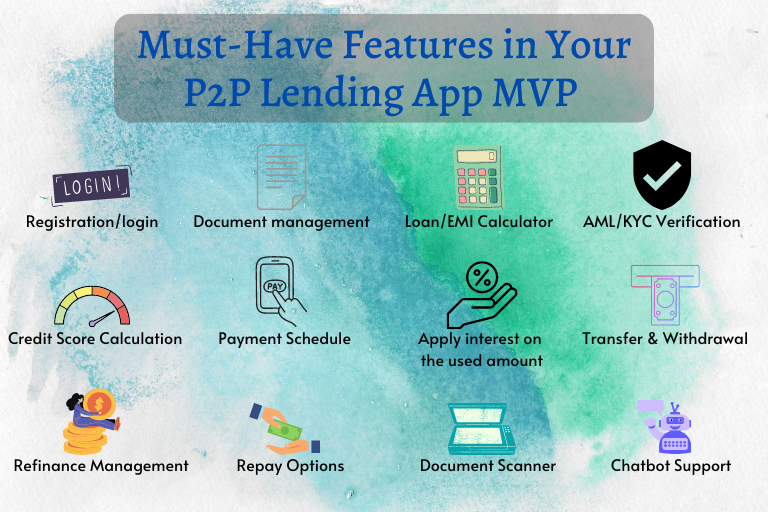

Here are the features required when building a P2P lending app like LendingClub.

For Borrowers

People will only register if the rates suit them. For rate calculation, the platform must collect user data to give an individual estimate of interest rate and monthly payments.

Show the loan calculator feature on the main page for the users to add personal information. This includes name, loan amount and purpose, income amount, address, occupation, email, etc.).

This too is a great lead generation tool as people leave their contact details. Through them, you can find potential clients.

Once the users enter their details, automatically create their user profile so that they can avoid the tedious registration process.

Once a borrower’s creditworthiness is checked, the loan is listed on the website and available for investors.

As borrowers and investors only interact online, loan agreements must also be signed electronically. So, integrate with eSignature solutions.

After the loan’s approval, the borrower’s bank account must automatically transfer money on the selected date. For this, implement a payment gateway like PayPal or Stripe as these support recurring payments.

It shows users the current loan status; money left to pay, amount repaid to date, the next payment due date, total time left to pay, etc.

Borrowers need to communicate with the platform administrators to get help. In-built a messenger or chat feature for quick communication.

Here, they can receive all updates regarding payment confirmation, the documents needed, etc. They can even ask for a new loan.

For Investors

For a new investor to register themselves, enable them to create an account. Add basic fields like contact and tax information.

Help the investors build a portfolio. Generally, lenders provide loans to many borrowers to reduce risks by diversifying the investments.

In such a way, even if one borrower defaults, the lender does not lose all of their money. They will be able to make up for the loss with payments from other borrowers.

Usually, platforms allow loans in ‘notes’ of $25 & they can make as many loans as they want.

Allow the investors to manually look up loan requests & choose the ones they are willing to support. Add a Search feature with filters like loan term, interest rate, loan purpose, & borrower credit score.

LendingClub allows users to download a spreadsheet of all available loans on the platform to analyze them offline in Excel.

Some investors don’t want to spend a lot of time on selecting a loan. Facilitate them to use an automatic matching algorithm that picks suitable loans as per the lender’s criteria.

It allows an investor to get a 360-degree view (see the full data) of their investments & revenues in one swift glance.

For Admin

Besides the borrower and investor sections, there is also a back-end. The platform admins manage all the processes here. The features include:

The admin must be able to view & manage all platform users, manually update their status, & approve loans.

This can either be a part of user management or a separate feature. It works as a tool to keep all the leads & current users’ contacts.

It also helps record valuable client notes and manage sales & marketing campaigns.

Allow the admins to create and edit various loan types & their characteristics (interest rates, payment options, & service fees).

Give admins the facility to update the website content like notifications, announcements, and blogs.

Admins need to keep track of all transactions passing through the website—subscription charges, fees from payments, penalties, etc.

If there are integrations with any third-party softwares, there should be a section where these connections are managed.

The key metrics must be displayed on the admin panel’s main screen. This will help the admin monitor the performance at a glance.

There are certain things that are often understated when it comes to building a P2P lending app.

Before creating the loan app, see if you want to offer unique mobile experiences for lenders and borrowers. If that’s the case, you would need two separate apps working together.

Want to build a loan app that stands out from the crowd and gives you a competitive edge? Adopt the latest AI/ML-backed app solutions and always stay on top of your game.

The developers at Code Brew Labs use a comprehensive suite of robust technologies and blockchain protocols to create a disruptive app.

Partner with us & allow your P2P lending app users to seamlessly lend or borrow crypto. Eventually, generate the most traction and scale growth!