In an era where financial flexibility is no longer a luxury but a necessity, cash advance apps have emerged as vital tools for everyday users. These mobile applications provide short-term, low- or no-interest cash advances to individuals in need of immediate funds—often to cover bills, groceries, or unexpected expenses—before their next paycheck arrives.

Table of Content

Among the pioneers of this fintech innovation is Dave, a widely recognized name in the industry. With a mission to eliminate overdraft fees and promote financial wellness, Dave disrupted the traditional lending model by offering small advances without predatory interest rates or credit checks. As economic uncertainty and inflation continue to challenge consumers in 2025, apps like Dave have seen a surge in adoption across the U.S. and globally.

The demand for early paycheck access solutions is at an all-time high, driven by the growing gig economy, rising living costs, and a population seeking alternatives to high-interest loans or payday lenders. Employees and freelancers alike are turning to Dave-like apps that provide a simple, fast, and secure way to bridge financial gaps without falling into a debt cycle.

In this blog, we’ll explore:

Whether you’re an entrepreneur, startup founder, or an enterprise exploring new fintech verticals, this guide will give you the clarity and confidence to develop a cash advance app like Dave that’s user-centric, scalable, and compliant.

Dave is a digital banking service. The service’s main focus is on cash advances. Founded in 2017, Dave was built on a simple idea—to help users avoid overdraft fees and access money when they need it most. Unlike traditional payday loans, Dave offers up to $500 in interest-free advances, based on a user’s income history and spending behavior. Its user-friendly interface, transparent practices, and built-in budgeting tools made it a top choice among users seeking smarter ways to manage their finances.

These features are not just functional—they reflect a deep understanding of financial anxiety and the need for simplicity and trust in personal finance apps.

Dave’s monetization strategy is unique. Rather than charging interest or enforcing harsh repayment penalties, the platform earns revenue through:

This business model supports ethical lending while remaining financially viable, a blueprint many Dave-like apps have since adopted.

Dave’s impact on the fintech landscape proves that there is both a moral and economic case for designing apps that support financial wellness. It also demonstrates the vast potential for businesses aiming to build an app like Dave with a user-first approach.

The rising popularity of cash advance platforms has led to an influx of innovative fintech solutions designed to offer users quick access to their earnings. While Dave continues to be a leader in the space, several apps like Dave have emerged, each with its own unique set of features, fee structures, and user experiences. Below is a curated list of the top 10 Dave alternatives in 2025—ideal references if you’re planning to build a cash advance app like Dave.

One of the most prominent Dave alternatives, Earnin allows users to access up to $750 of their paycheck ahead of time with no fees or interest.

Key Features:

Earnin focuses on employee empowerment with zero-cost borrowing and seamless integration with work schedules.

Brigit combines cash advances with credit protection and financial monitoring tools.

Key Features:

Brigit’s AI budgeting and credit-building options set it apart from other Dave-like apps.

A full-service fintech app that blends cash advances, mobile banking, and investment tools.

Key Features:

A holistic financial platform, ideal for users looking beyond just paycheck advances.

Albert offers smart cash advances along with automated savings and investment options.

Key Features:

Combines cash advance services with AI-powered financial coaching.

While not a cash advance app by design, Chime offers early paycheck access through its neobank model.

Key Features:

Integrates early pay access with full-service mobile banking.

Empower focuses on instant cash advances and long-term financial wellness.

Key Features:

Empower balances cash advance access with proactive spending controls.

Klover enables paycheck advances without fees or credit checks—powered by data-sharing consent.

Key Features:

A unique model that rewards users for engagement instead of charging fees.

FloatMe is tailored for younger users and those new to credit.

Key Features:

A minimalist alternative, great for Gen Z users with simple financial needs.

: Vola offers instant advances while helping users improve spending habits.

Key Features:

Combines lending with educational tools, ideal for first-time borrowers.

A responsible lending app that helps build credit while offering fast access to cash.

Key Features:

One of the few Dave alternatives that supports long-term credit health via installment payments.

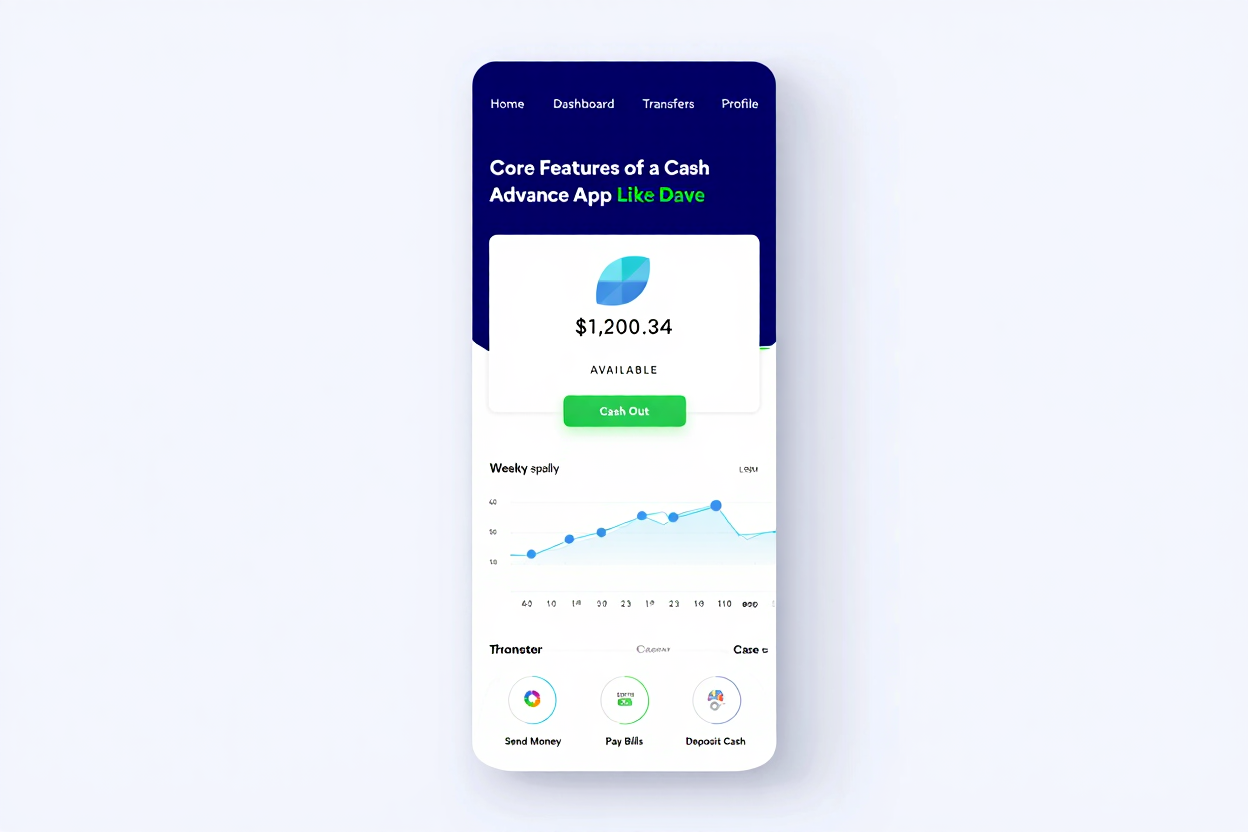

If you’re planning to create a cash advance app like Dave, integrating the right features from the ground up is crucial—not only for user experience but also for security, compliance, and scalability. Below are the essential components every Dave-like app should include:

Helps meet compliance and builds trust with users.

Ensures the app can safely assess user financial behavior and disburse advances accordingly.

This is where AI agent development enhance risk management and decision-making.

The foundation of any app aiming to replicate or improve upon the Dave model.

Builds user loyalty and positions your app as a financial wellness platform.

A proactive feature that enhances retention and utility.

User-centric repayment features reduce delinquency rates.

Keeps users engaged and informed—critical for mobile app retention.

Investing in AI chatbot solutions improves responsiveness and reduces human support costs.

Enables monetization at scale while keeping your app accessible to budget-conscious users.

Developing a cash advance app that mirrors the success of Dave requires a careful blend of strategy, technology, user trust, and compliance. Here’s a step-by-step approach to build a cash advance app like Dave in 2025:

Before anything else, understand your target audience—whether it’s salaried employees, freelancers, or gig workers. Dive into competitors’ offerings, fee structures, pain points, and user reviews. Simultaneously, research financial regulations in your region, including laws related to payday lending, data privacy (GDPR, CCPA), and digital banking.

Knowing your market ensures that your app not only solves real problems but also operates legally and sustainably.

Decide how your app will generate revenue:

Your choice should align with your audience’s ability to pay and the long-term scalability of your platform.

To enable seamless money transfers and account access, either:

This is essential to assess a user’s income patterns and offer instant cash advances.

List core functionalities such as advance disbursement, AI-based income prediction, budgeting tools, notifications, and KYC verification. Then, structure your backend architecture to support these features at scale and with minimal latency.

Collaborate with a proven mobile app development company that specializes in fintech and understands regulatory nuances, financial APIs, and AI integration. An experienced partner will help you avoid common pitfalls and speed up go-to-market timelines.

Keep the interface clean, intuitive, and transparent. Financial apps deal with sensitive data—visual clarity, simplified flows, and reassuring microcopy will improve user engagement and trust.

Start lean with an MVP that includes essential features like registration, bank sync, cash advance, and repayment. Use real user feedback to refine and optimize the experience before scaling.

Work with legal consultants to make sure your app complies with:

Compliance not only prevents legal risks but also builds long-term user trust.

After launch, monitor KPIs such as user acquisition, retention, repayment rates, and server uptime. Use analytics and feedback loops to iterate, add new features, and improve security. Cloud-native architecture will ensure you can scale quickly as your user base grows.

To develop a cash advance app like Dave, you need a robust and scalable tech stack:

| Component | Recommended Technologies |

| Frontend | React Native or Flutter for cross-platform development |

| Backend | Node.js or Python (Django/FastAPI) for API-driven architecture |

| Database | PostgreSQL or MongoDB for structured and flexible storage |

| Banking APIs | Plaid, Yodlee, Finicity for account verification and transaction data |

| AI/ML | Income prediction, budgeting tools using custom ML models |

| Cloud Hosting | AWS or Google Cloud for secure and scalable deployment |

| Security | AES-256 encryption, biometric login, OAuth 2.0, SSL/TLS |

If you’re considering AI development services, they can be pivotal in enabling predictive analytics and personalized financial coaching within the app.

Building a cash advance app like Dave in 2025 involves several dynamic factors—ranging from app complexity and feature set to development team expertise and region. While many sources throw out ballpark figures, let’s break it down into realistic numbers based on current trends and industry standards.

For a Minimum Viable Product (MVP) version of a payday loan or cash advance app like Dave, the cost typically ranges between $10,000 to $15,000. This budget is suitable for an initial launch version that includes core features like:

As you add more advanced features like AI-driven financial insights, subscription models, credit-building tools, multi-platform support, or biometric security, the cost can scale up significantly—often reaching $30,000 to $75,000+ for a production-ready app.

| Component | Estimated Cost Range |

| UI/UX Design | $1,500 – $4,000 |

| Backend Development | $3,000 – $10,000 |

| API Integrations (Plaid, Stripe, etc.) | $2,000 – $5,000 |

| AI/ML for Financial Forecasting | $4,000 – $12,000 |

| Testing & QA | $1,000 – $3,000 |

| Maintenance & Updates (monthly) | $500 – $2,000 |

Pro Tip: Starting lean with essential features can get your app to market faster. Once you validate your user base, you can scale up with premium features.

Hiring an app development team from different parts of the world will impact your cost:

If you’re building a cash advance app like Dave in 2025, starting with a budget of $10,000 to $15,000 is realistic for an MVP. However, to compete with industry leaders and ensure scalability, budgeting up to $50,000 or more is recommended—especially when aiming for enterprise-grade features, top-tier UI/UX, and regulatory compliance.

Building Dave-like apps comes with several challenges, particularly in the fintech space:

A well-planned monetization model ensures your app stays profitable without compromising user experience:

Allow users to voluntarily tip for cash advances, similar to Dave. Builds goodwill and flexibility.

Offer users premium features like larger advances, credit building, and financial coaching for a monthly fee.

Promote third-party services like job boards, insurance, credit repair, and earn commission.

Integrate BNPL, digital banking, or personal loans to expand your offerings.

Provide core features for free and unlock advanced features through in-app purchases or upgrades.

As a leading mobile app development company and provider of AI development services, we specialize in creating secure, scalable, and compliant fintech solutions. Here’s how we support businesses that want to create an app like Dave:

The fintech space is rapidly evolving, and Dave-like apps will continue to transform with new technologies:

The rise of cash advance apps like Dave reflects a massive shift in how consumers manage money. As financial needs become more immediate and personalized, there’s a significant opportunity for fintech innovators to step in.

If you’re planning to build a cash advance app like Dave, the time is now. By focusing on ethical lending, data-driven insights, and user-first design, you can create a powerful solution that not only drives revenue but also makes a positive impact.