BharatPe is a one-stop shop for digital payments. As per BharatPe co-founder Shashvat Nakrani, the idea of building an app like BharatPe was focused on the solving the challenge faced by merchants/SMEs to accept digital payments without losing out on margins. As no payment gateway was charging less than 1% of commission, Shashvat Nakrani who was working on a startup idea in 2017-18 decided to leverage UPI to build a digital payments solution that would remove all charges on receiving payments, build a network of merchants, and monetize through other financial products.

Table of Content

Most companies were following a closed ecosystem at that time, so merchants had to install different QR codes for receiving payments through different payment gateways. But BharatPe leveraged on key feature of UPI – interoperability. This helped merchants as they now needed only one QR code to receive payments from all Government backed payment gateways and that too without any transaction fees.

A big question that surrounds BharatPe is that if it allows free transactions, then how does it earn? The co-founder and CEO of BharatPe, Ashneer Grover had an observation while working with different banking and investment firms. He noticed that since margins were low in retail, local merchants or shopkeepers were not ready to pay for services such as digital payments. But they were ready to pay interest on loans for expanding their business. However, it was tough for them to borrow loans from banks due to great deal of paperwork.

With its unique business plan, BharatPe decided to tap into this gap and offer loans to merchants or local shopkeepers for generating revenue.

BharatPe commercially launched its QR Code in August 2018 and started lending loans six months after that. For loan disbursal, it partnered with financial companies or peer-to-peer NBFCs such as LiquiLoans and LenDenClub. Since its launch, BharatPe has seen immense growth and has become 19th startup to enter the list of Unicorn startups in 2021.

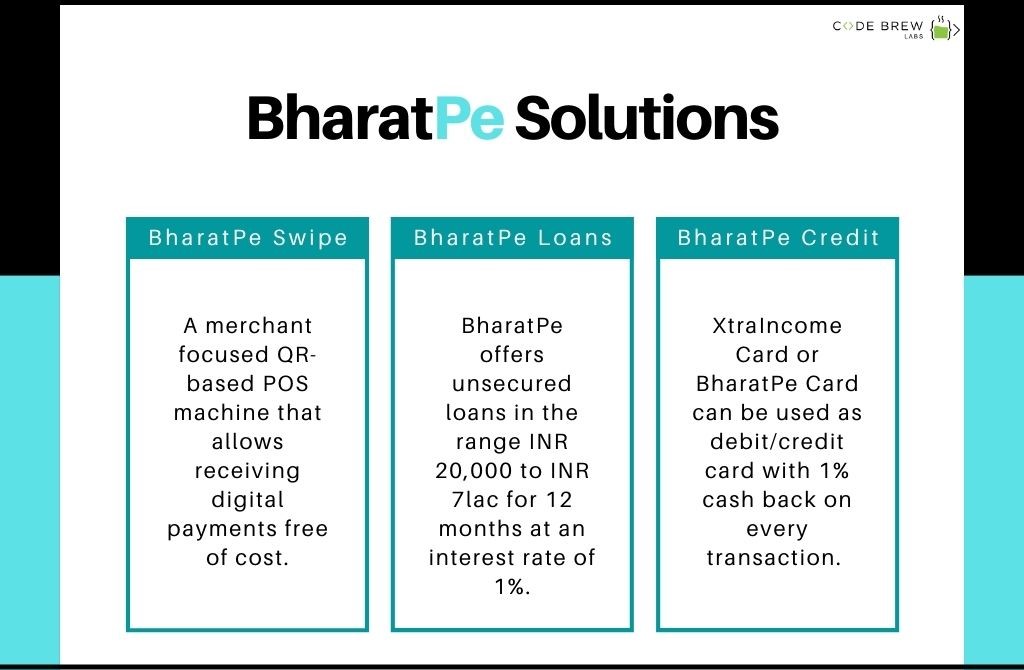

BharatPe now offers multiple products to merchants. Here is a brief insight into the products offered by BharatPe:

BharatPe Solutions

BharatPe Swipe: BharatPe Swipe is a QR based Point Of Sale (POS) machine that allows the merchants to accept digital payments from multiple payment gateways or mobile apps such as PayTm, WhatsApp, Mobikwik, Amazon Pay, Google Pay, BHIM, and Freecharge. BharatPe solved two major problems of merchants:

These benefits resulted in a rise of BharatPe users resulting in more than 10,000,000 downloads from Google Play till date.

BharatPe Loans: BharatPe offers unsecured loans to SME merchants. The loan amount disbursed by BharatPe ranges between INR 20,000 to 7 lakh. The loan tenure is up to 12 months with an interest rate of 2% per month. Till date, BharatPe processes loans worth INR 3 Crore each month. BharatPe allows merchants to pay back loan in easy daily installments. Instead of requiring merchants to make daily payments, BharatPe deducts the installment amount from QR transactions amount before bank settlement each day. Owing to this method BharatPe has a repayment rate of 96%.

BharatPe Credit: BharatPe launched a credit line on XraIncome Card. The card has been renamed as BharatPe Card. This card can be used by merchants to draw credit worth INR 25,000. The credit card offers 30 day interest free benefit to the merchants along with 1% cash back on every transaction. BharatPe card can be used as either a debit or a credit card.

After being launched in August 2018, BharatPe has come a long way and got listed in the list of Unicorn startups in August 2021. Till date, BharatPe has raised approximately $660.3M in over 8 rounds of funding. After its latest funding round on August 4, 2021 BharatPe has reached a valuation of $2.85 billion; thus, becoming a unicorn startup.

Here is a complete account of BharatPe funding:

If you are also intrigued by the success of BharatPe app, here are some features that make BharatPe app popular:

The development cost of app like BharatPe depends upon the location of development company, panels and features of app, UI/UX of the app, and supporting platforms. Depending upon the mentioned factors, the cost may range from $200-$250 in US and $40-$60 per hourly basis in Asian countries. Code Brew Labs offers an affordable solution to build app like BharatPe. The mobile app development company offers ready-to-use base solution to build BharatPe clone which can be customized to suit your business needs. Let’s connect now!