Introduction

The digital banking landscape has transformed dramatically over the last decade, and 2025 is proving to be the year of hyper-personalized, AI-powered, and ultra-secure mobile applications. Among the frontrunners in this fintech revolution is HSBC, whose mobile banking application sets a high benchmark for what a seamless digital banking experience should look like.

Creating an app like HSBC in 2025 isn’t just about coding a set of financial tools, it’s about building trust, integrating cutting-edge technologies, following strict compliance protocols, and delivering an exceptional user experience across devices and demographics. Whether you’re a startup entering the fintech space or an established bank aiming to modernize, understanding HSBC’s model can offer valuable insights.

In this in-depth guide, we’ll walk you through everything you need to know to build a mobile banking app like HSBC, from market trends and must-have features to tech stacks, costs, and legal compliance.

Understanding the HSBC Mobile Banking Model

Key Features of the HSBC Mobile App

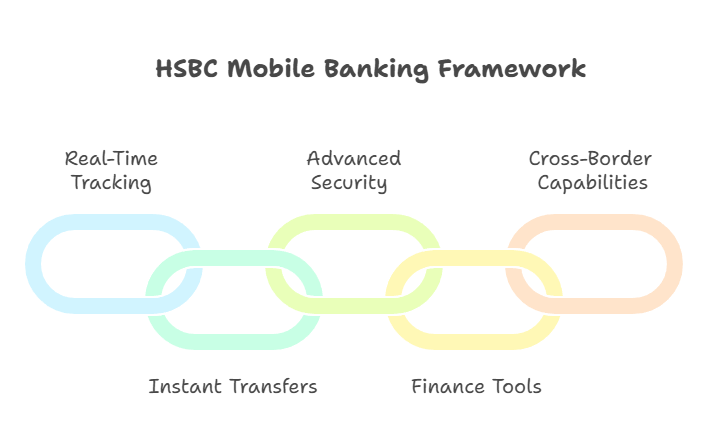

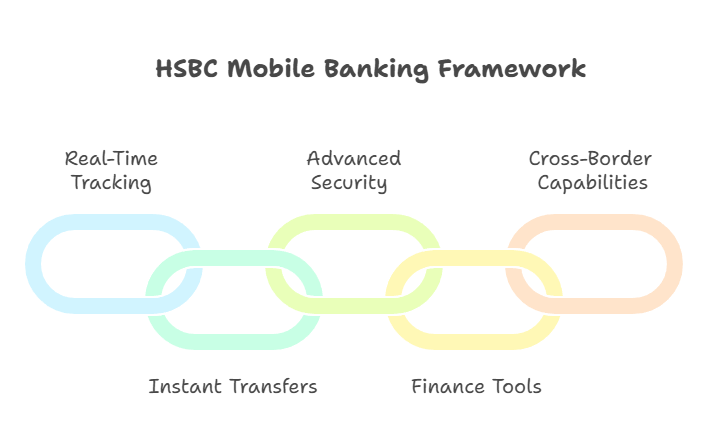

HSBC’s mobile banking app is renowned for its intuitive interface and robust set of features that cater to personal and business banking needs. Here’s a deep dive into the essential features that make HSBC’s app a leader in the industry:

- Real-Time Account Tracking: Users can access their current and savings account balances, recent transactions, and scheduled payments in real time, offering full control over their finances at any moment.

- Instant Transfers & Payments: HSBC enables quick domestic and international fund transfers, bill payments, and even QR-based peer-to-peer payments. The app is integrated with SWIFT and SEPA systems for global compatibility.

- Advanced Security: Biometric authentication, multi-factor login systems, and AI-based fraud detection tools ensure user data and transactions remain highly secure.

- Integrated Personal Finance Tools: The app helps users budget better with visual dashboards, categorized spending insights, and monthly financial health reports powered by AI.

- Cross-Border Capabilities: HSBC allows users to manage multiple currencies and global accounts from a single app interface—ideal for frequent travelers or expats.

What makes these features powerful is not just their presence but how seamlessly they work together. They offer utility, accessibility, and peace of mind—three pillars of a strong mobile banking experience.

Unique Selling Propositions (USP) of HSBC’s App

What truly distinguishes HSBC’s mobile app from others on the market isn’t just the depth of its features, it’s the strategic thinking behind them. Here are the unique selling points that give HSBC its competitive edge:

- Global Accessibility: HSBC’s app is accessible in over 60 countries, with multilingual support and localization features tailored to specific regulatory environments. Users can open and manage offshore accounts, exchange currencies, and handle international transactions effortlessly.

- AI-Powered Insights: The app uses AI to offer customized financial advice, suggest better saving habits, and even warn users of potential overdrafts or suspicious activity. It’s like having a financial advisor in your pocket.

- Seamless Omnichannel Integration: Whether users switch from web banking to mobile or engage with customer support through live chat or voice assistants, the transition is smooth. All data is synchronized in real time.

- Eco-Friendly Focus: HSBC promotes paperless banking with e-statements, digital receipts, and a carbon-tracking feature that estimates the environmental impact of your transactions—a big win for sustainability-conscious users.

- Scalable Infrastructure: The backend is built on cloud-native architecture that supports millions of concurrent users without lag, making the app incredibly reliable and fast.

The takeaway here? If you’re building an app to rival HSBC’s, think beyond features. Focus on scalability, personalization, and the ability to offer real-world value at every touchpoint.

Why Build a Mobile Banking App in 2025?

Market Demand & Industry Trends

The world of banking is undergoing an irreversible transformation, and mobile apps are at the center of it. By 2025, over 75% of banking interactions globally are projected to occur via smartphones. Let that sink in.

- Millennials and Gen Z, who make up the largest segment of the workforce, expect banking to be digital-first.

- According to Statista, the global mobile banking market is expected to surpass $1.8 trillion in transactions by the end of 2025.

- Neobanks and digital-only financial institutions are disrupting traditional models, making mobile app innovation a necessity, not a luxury.

Emerging technologies like AI, blockchain, and IoT are reshaping consumer expectations. Users don’t just want to check balances anymore, they want smart recommendations, voice-based commands, and proactive fraud alerts.

In this environment, developing a mobile app is one of the most lucrative and strategically sound decisions for fintech startups and legacy banks alike.

Competitive Advantage & Revenue Potential

A well-built mobile banking app does more than offer convenience, it drives real business growth. Here’s how:

- Customer Retention: A feature-rich and intuitive app increases customer stickiness. When users can do everything from budgeting to investing within one app, they’re less likely to churn.

- Data Monetization: With user consent, anonymized transaction data can be used to derive insights, develop new products, or offer personalized marketing.

- Cross-Selling Opportunities: Mobile apps are perfect for upselling financial products, credit cards, insurance, mutual funds—right when the user needs them.

- Cost Reduction: Digitizing services through an app reduces operational costs (branch visits, paperwork, staff support), resulting in higher margins.

In short, creating a mobile banking app today is not just about matching the competition—it’s about positioning your brand for long-term profitability and customer loyalty in a rapidly digitizing world.

Core Features Every Banking App Must Have in 2025

Basic Banking Functions

When you strip a banking app to its core, it must still fulfill traditional banking needs—just faster, easier, and more securely. These are non-negotiables:

- Account Overview: Real-time updates on checking, savings, and credit card accounts with clean, intuitive dashboards.

- Transaction Management: Transfer money between accounts, schedule recurring payments, and view categorized transaction histories.

- Bill Payment: Enable auto-pay, add payees with a simple scan or voice input, and send payment reminders.

- Notifications and Alerts: Push notifications for debits, credits, large transactions, or balance thresholds keep users in control.

But basic doesn’t mean boring. Even these functions should feel fluid and empowering to users. A poorly executed dashboard or glitchy transaction system can kill user trust fast.

Advanced Functionalities

Now that the basics are in place, it’s time to talk about what separates a great banking app from a groundbreaking one. Advanced functionalities are not just bells and whistles—they’re rapidly becoming standard user expectations in 2025.

Here are some high-impact features you should consider:

- AI-Driven Financial Advice: Imagine logging into your banking app and being greeted with personalized financial suggestions based on your spending patterns. Whether it’s a prompt to save for a vacation, adjust your budget, or invest surplus funds, AI algorithms are doing all the thinking behind the scenes.

- Budgeting and Spending Analytics: Pie charts, trend graphs, and color-coded spending categories aren’t just pretty, they help users make better financial decisions. With machine learning, these tools can also project future expenses and send preemptive warnings.

- Voice Banking & Chatbots: With voice assistants like Alexa and Siri becoming household names, users expect voice-activated services. Integrating voice commands allows them to check balances, pay bills, or report a lost card hands-free. Meanwhile, AI-powered chatbots handle 80% of customer queries without human intervention.

- Contactless Payments and QR Integration: With digital wallets on the rise, contactless is now expected. NFC payments, QR scanning for peer-to-peer transfers, and one-click payments are not just convenient—they’re essential.

- Virtual Cards and Instant Issuance: Provide users with a virtual debit or credit card that they can use instantly upon account creation. It adds speed and increases user satisfaction, especially for digital natives.

- Dark Mode & Accessibility Features: With visual comfort and inclusivity becoming priorities, customizable themes and screen-reader compatibility are also must-haves.

- Savings Goals & Gamification: Users can set custom goals, like saving for a car or a trip—and the app helps track progress. Gamification, like achievement badges or progress bars, adds a fun twist to serious finance.

In 2025, banking apps need to do more than bank. They must empower, predict, and respond intelligently to user needs in real-time. This is what customers expect, and it’s where your app can truly shine.

Security and Compliance

Security is non-negotiable in banking, especially when your entire financial presence is mobile-first. One breach, and your credibility—and your users—are gone.

Here are the mission-critical components to lock down your app’s security in 2025:

- Biometric Authentication: Facial recognition, fingerprint scanning, and even behavioral biometrics are now standard. These methods not only boost security but also enhance convenience.

- Multi-Factor Authentication (MFA): In addition to biometrics, combining one-time passwords (OTP), email confirmations, or app-generated security codes gives layered protection.

- End-to-End Encryption: All user data, from passwords to transaction history, should be encrypted using the latest standards (AES-256, SSL/TLS 1.3) to prevent interception.

- Session Timeout & Remote Logout: Automatically logging users out after inactivity or letting them end sessions on other devices remotely is a crucial safeguard.

- Real-Time Fraud Monitoring: With AI machine learning, suspicious activity—like a sudden overseas login or an unusually large transfer—can be flagged instantly.

- Compliance with Global Standards:

- GDPR for data protection and user consent (Europe).

- PSD2 for payment services and open banking (EU/UK).

- PCI-DSS for handling card transactions securely.

- SOX, CCPA, and local central bank regulations, depending on your target markets.

Also, every data touchpoint in your app—logins, money transfers, account updates—must be audited and traceable in case of regulatory investigations.

Security builds trust. And in banking, trust is your currency. HSBC didn’t become a global banking titan by cutting corners in security, and neither should you.

Technology Stack for Mobile Banking App Development

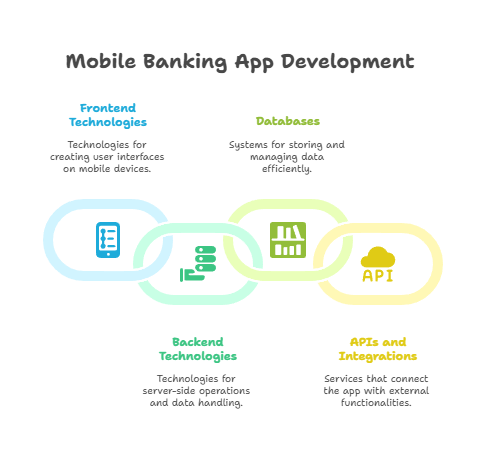

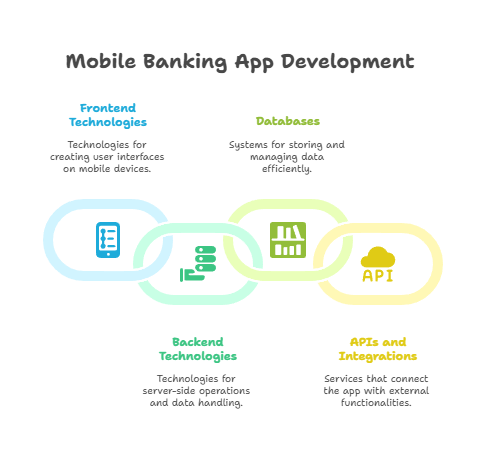

Frontend & Backend Technologies

Choosing the right technology stack is the foundation of a high-performing banking app. Here’s what the top developers are using in 2025:

Frontend (User Interface) Technologies:

- React Native and Flutter: Ideal for cross-platform development (iOS + Android) with a single codebase, which reduces costs and time-to-market.

- Swift (iOS) and Kotlin (Android): Preferred for native development when performance and deeper OS integrations are needed.

Backend (Server Side) Technologies:

- Node.js: Perfect for handling multiple concurrent users and building scalable APIs.

- Python (Django/Flask): Offers great data handling and AI integration capabilities.

- Java / Spring Boot: A legacy favorite in banking, known for its robustness and enterprise-grade security.

Databases:

- PostgreSQL or MySQL for relational data.

- MongoDB or CouchDB for non-relational data and flexibility.

- Redis for caching to improve speed.

APIs and Integrations

APIs are the lifelines of a digital banking ecosystem. Here are some must-have integrations:

- Banking Aggregators: Integrate with platforms like Plaid, Yodlee, or Tink to allow users to link and manage external bank accounts.

- Payment Gateways: Seamless integration with Stripe, Razorpay, PayPal, and regional gateways ensures smooth transactions.

- Credit Score APIs: Pull credit data securely using Experian, Equifax, or CRED to offer tailored financial products.

- AML/KYC Verification APIs: Automate identity verification through platforms like Jumio, Shufti Pro, or Onfido.

- Notification Services: Use Firebase Cloud Messaging or OneSignal for real-time updates and alerts.

Well-integrated APIs speed up development and enhance functionality—don’t reinvent the wheel when these services already exist.

Cloud & DevOps

Scalability, uptime, and speed are non-negotiable. A solid cloud and DevOps strategy makes sure your app can handle growth and evolve rapidly.

- Cloud Providers: Use AWS, Microsoft Azure, or Google Cloud Platform (GCP) for reliable cloud hosting, data storage, and security compliance.

- DevOps Tools:

- Docker & Kubernetes for containerization and orchestration.

- Jenkins, GitHub Actions, or GitLab CI/CD for automated testing and deployment.

- Terraform or Pulumi for infrastructure-as-code (IaC).

- Monitoring Tools: Use Datadog, New Relic, or Sentry for real-time performance monitoring and error tracking.

These tools ensure your mobile banking app remains fast, reliable, and ready for future updates with minimal downtime.

UI/UX Design Principles Inspired by HSBC

Minimalist and User-Centric Design

When users open a banking app, they’re not looking to be dazzled—they’re looking for clarity, control, and efficiency. HSBC’s app design excels by sticking to minimalist, user-first principles. If you’re aiming to replicate their success, your UI/UX needs to reflect the same core ideologies:

- Clean Layouts: White space is your friend. HSBC uses a clean, decluttered layout that allows users to process information quickly. No overwhelming dashboards, no unnecessary pop-ups—just intuitive design.

- Intuitive Navigation: Menus are logically grouped, search functionality is prominent, and the most-used features (like recent transactions or balance checks) are front and center.

- Accessible Language: The content in HSBC’s app avoids jargon and keeps instructions simple. This inclusivity makes it usable for all types of users, not just tech-savvy ones.

- Consistent Visuals: Color schemes and iconography are consistent across every screen. HSBC often uses red and white as part of their branding, subtly reinforcing brand identity without overwhelming the UI.

A user-centric design isn’t just about looking good, it’s about delivering value quickly. Your app should answer one question: Can a user complete their task with as few taps as possible?

To reach that point, involve real users early in the design process. Use surveys, testing, and UX heatmaps to identify friction points. Iterate based on feedback, not assumptions.

Mobile-First Experience

In 2025, mobile-first is not a trend, it’s the standard. Most users won’t even visit a physical bank, let alone a desktop site. Your banking app should be built from the ground up with smartphone behavior in mind.

Here’s how to master mobile-first design:

- Responsive Design Elements: Whether a user is on an iPhone Mini or a Galaxy Fold, the UI must adapt. Use fluid grids, scalable vector graphics (SVGs), and flexible layouts to ensure consistency.

- Thumb-Friendly Interactions: Place clickable elements within the thumb’s natural range—bottom corners and lower center of the screen are optimal zones. Avoid placing key actions in hard-to-reach areas.

- Offline Capabilities: HSBC allows some functionality (like viewing recent transactions) even without an internet connection. Caching important data enhances usability during low connectivity.

- Lightweight Performance: Keep your app’s size under control. HSBC ensures fast load times by optimizing assets and reducing unnecessary animations or background services.

- One-Handed Use: Consider one-handed interactions. This might mean collapsible menus, floating action buttons, or swipe gestures to reduce navigation complexity.

You can learn a lot from how HSBC tailors their mobile experience. Their philosophy? Make every interaction frictionless, every action intuitive, and every second count.

A Step-by-Step Guide to Building a Mobile Banking App

Step 1: Market Research and Planning

Before writing a single line of code, you need to understand the landscape. This step lays the foundation for everything that follows.

- Identify Your Target Audience: Are you building for retail customers, SMEs, or high-net-worth individuals? Each group has unique banking needs. Tailoring features to their preferences increases adoption.

- Competitive Analysis: Study top apps in your region—HSBC, Revolut, Chime, N26. What do they do well? Where do they fall short? SWOT analysis can help you carve out your unique value proposition.

- Define Your Goals: Is your app about convenience, cost-efficiency, or innovation? Your business goals will shape everything—from the tech stack to the user interface.

- Set KPIs: Determine early success metrics like DAU/MAU (daily/monthly active users), transaction volume, churn rate, and feature adoption rates. Without KPIs, you can’t measure progress.

Failing to plan is planning to fail. You’re not just building an app—you’re entering a tightly regulated, high-trust industry. Start with research, and your future self will thank you.

Step 2: Design & Wireframing

Now it’s time to bring your vision to life. Wireframes are blueprints that outline app functionality, layout, and flow before actual design or development begins.

- Low-Fidelity Wireframes: These are simple sketches of each screen. Focus on layout and navigation, not visuals. Tools like Balsamiq are great for early drafts.

- High-Fidelity Prototypes: Use tools like Figma, Adobe XD, or Sketch to add detailed UI elements, colors, and micro-interactions. These prototypes simulate a real user experience.

- User Flow Mapping: Design how users will navigate your app, from logging in to making a payment or applying for a loan. Ensure the journey feels natural and quick.

- Feedback Loops: Share wireframes with stakeholders and real users. Gather feedback on usability, design clarity, and emotional response. Revise accordingly.

This phase may feel like a detour, but it’s not. Investing time in design reduces code rework, improves user adoption, and speeds up overall development.

Step 3: Development and Testing

Time to get technical. This phase converts your wireframes into a fully functional mobile banking app.

- Agile Development: Break the project into sprints (2-4 weeks each). This lets you iterate faster, pivot when necessary, and involve QA from the start.

- Version Control & Collaboration: Use GitHub or GitLab for source control. CI/CD pipelines allow for automated builds, tests, and deployments.

- Backend & API Development: Build secure APIs to handle login, transaction management, account updates, and alerts. Use REST or GraphQL for communication between the front and backend.

- Data Security Implementation: Encrypt all sensitive data, enable audit logging, and deploy rate-limiting to guard against brute-force attacks.

- Rigorous Testing:

- Functional Testing: Ensure all features work as intended.

- Performance Testing: Test for load, speed, and scalability.

- Security Testing: Run penetration tests, vulnerability scans, and ethical hacks.

- User Testing: Use beta testers to gather feedback on usability and bugs.

Remember: banking apps deal with real money. Your testing should be twice as rigorous as any e-commerce or social media app.

Step 4: Deployment and Monitoring

The final stretch! After months of development and testing, it’s time to go live—but smartly.

- App Store Deployment: Prepare polished listings with screenshots, feature descriptions, and compliance details. Apple and Google are very strict with fintech apps, so prepare for a back-and-forth review.

- Backend Infrastructure Launch: Your servers should be ready to handle real-time traffic. Use autoscaling in your cloud setup to handle spikes, especially after launch.

- Error Monitoring: Integrate tools like Sentry, Crashlytics, or AppDynamics to catch crashes and bugs in real time.

- User Onboarding: Keep onboarding short and guided. Use tooltips, animations, and skip options to minimize friction.

- Post-Launch Feedback: Actively monitor reviews, ratings, and user feedback. Update the app frequently to fix bugs and roll out new features.

Launching is just the beginning. Your success lies in how well you adapt post-launch, just like HSBC continues to evolve based on user feedback and fintech trends.

Compliance and Legal Considerations

Regulations to Adhere To

Building a mobile banking app means stepping into one of the most heavily regulated industries in the world. Unlike other mobile apps, you can’t just launch and iterate—legal compliance needs to be baked in from day one.

Here are the major global and regional regulations you must address:

- PCI DSS (Payment Card Industry Data Security Standard): Mandatory if you handle credit/debit card transactions. It includes strict rules about data encryption, network security, and access control.

- GDPR (General Data Protection Regulation): Required if you’re dealing with users in the EU. It mandates data transparency, user consent, the right to be forgotten, and strict breach reporting timelines.

- PSD2 (Payment Services Directive 2): Applicable in the EU and UK, this regulation promotes open banking. You must allow third-party integrations while maintaining user control and consent.

- KYC (Know Your Customer): A must-have for verifying user identities, especially for onboarding. You’ll need to implement video KYC, document uploads, and biometric checks.

- AML (Anti-Money Laundering): You’ll need to monitor and report suspicious transactions. This means integrating with AML systems and creating audit logs.

- SOX (Sarbanes-Oxley Act): U.S.-based apps dealing with public companies must comply with SOX, which governs internal financial reporting controls.

- Local Central Bank Guidelines: Every region has its specific requirements, like the RBI (India), MAS (Singapore), or SAMA (Saudi Arabia). You must secure the necessary licenses before operations.

Failing to comply can result in fines, bans, or worse—loss of user trust. That’s why compliance officers, legal advisors, and infosec experts should be part of your core team from day one.

Data Privacy & Ethical Concerns

Beyond legal requirements, users in 2025 expect ethical responsibility from the apps they trust with their money. Here’s how to meet those expectations:

- Transparent Data Use: Make it crystal clear how user data is collected, stored, and used. Include easy-to-read privacy policies and clear opt-ins for things like personalized offers.

- Consent Management: Provide options for users to opt in/out of marketing, data tracking, and third-party integrations. Respect their choices across all devices.

- Data Minimization: Only collect what you need. The less data you store, the lower your risk exposure.

- Third-Party Risk Management: Any SDK or plugin you use must meet your security and compliance standards. Vet all vendors and require SOC 2 or ISO 27001 certifications.

- Ethical AI Use: If you’re using AI development services to offer credit, investment advice, or behavioral analysis, ensure it’s fair and explainable. Avoid black-box algorithms that users can’t understand.

Trust isn’t built overnight. By prioritizing privacy and ethical behavior, you’re not just avoiding lawsuits—you’re building loyalty.

Cost of Developing a Mobile Banking App Like HSBC

Cost Breakdown by Stages

Creating a mobile banking app is a major investment, but it pays off if done right. Here’s a rough breakdown of what you can expect to spend:

| Development Phase |

Estimated Cost (USD) |

| Market Research & Planning |

$10,000 – $20,000 |

| UI/UX Design |

$15,000 – $30,000 |

| Frontend Development |

$25,000 – $50,000 |

| Backend Development |

$30,000 – $70,000 |

| API Integrations |

$10,000 – $25,000 |

| QA & Testing |

$10,000 – $20,000 |

| Security & Compliance |

$15,000 – $40,000 |

| Deployment & Maintenance |

$10,000 – $30,000 |

Total Estimated Cost: $125,000 – $285,000+

Prices vary based on location, complexity, and your choice of technology stack. Offshore teams (e.g., in Eastern Europe or South Asia) can reduce costs significantly, though quality and compliance expertise should never be compromised.

Factors Affecting the Total Cost

Several variables influence how much you’ll ultimately spend:

- App Complexity: More features mean more development time, more testing, and more costs.

- Tech Stack: Using native platforms for iOS and Android costs more than cross-platform tools like Flutter or React Native.

- Security Needs: The higher the security standard (e.g., military-grade encryption, biometric integration), the higher the development cost.

- Regulatory Complexity: Operating in multiple regions with different compliance rules increases both time and cost.

- Design Standards: Custom animations, unique branding, and premium UI/UX design add to the budget.

- Third-Party Integrations: API licensing fees for services like Plaid, Onfido, or credit bureaus also contribute.

Think of your budget as an investment. A polished, secure, and scalable app brings returns not just in revenue, but in brand value, user trust, and long-term growth.

Choosing the Right App Development Partner

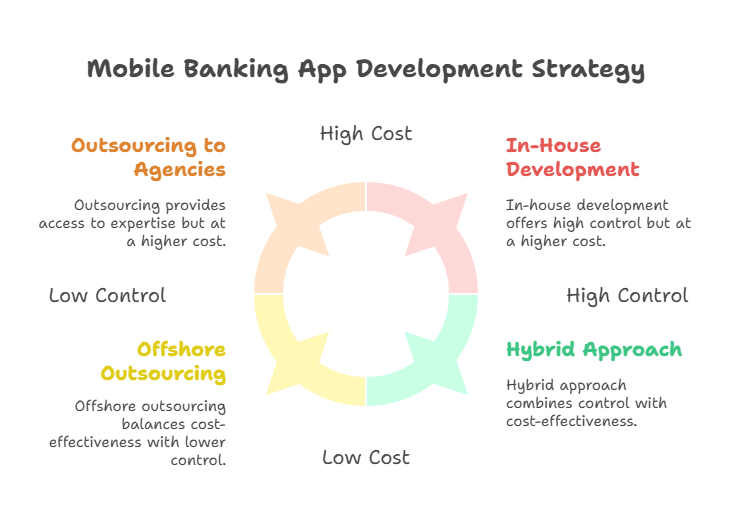

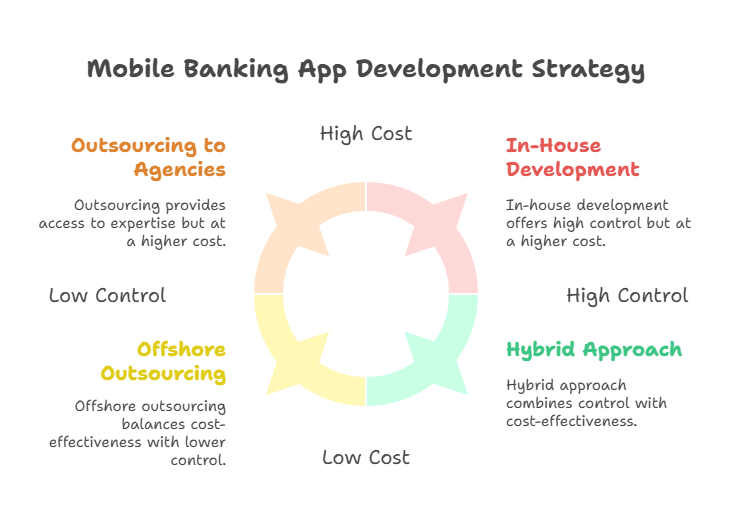

In-house vs. Outsourcing

One of the biggest decisions you’ll make is whether to build your app internally or hire an agency. Both have pros and cons:

In-House Development:

- Pros: Full control, direct communication, long-term team building.

- Cons: Higher upfront costs, longer recruitment process, limited expertise.

Outsourcing to Agencies:

- Pros: Access to expert talent, faster delivery, cost-effectiveness (especially offshore).

- Cons: Risk of communication gaps, time zone challenges, and quality assurance concerns if not vetted properly.

The ideal choice depends on your priorities—control vs. speed, cost vs. quality, short-term MVP vs. long-term scale.

What to Look for in a Mobile App Development Agency

If you choose to go the agency route, here’s your checklist:

- Fintech Experience: Make sure they’ve built similar apps—ask for case studies and client references.

- Security First Approach: They should have experience handling PCI, KYC, and GDPR requirements.

- Transparent Process: Agencies should offer clear timelines, cost estimates, and agile sprint planning.

- Support & Maintenance: Post-launch support is critical. Look for agencies that offer SLA-backed services and regular updates.

- UI/UX Expertise: A beautiful interface drives user retention. Choose partners who can combine design and functionality.

Vet your partner thoroughly. Think of them not just as vendors, but as an extension of your product team.

How HSBC Stays Ahead: Future of Mobile Banking

AI and Machine Learning Integration

HSBC’s app isn’t just smart—it’s evolving. Artificial intelligence and machine learning are the driving forces behind that evolution. If you’re serious about creating a next-gen banking app in 2025, AI must be at the core of your product roadmap.

Here’s how HSBC uses AI—and how you can, too:

- Personalized Insights: HSBC uses machine learning to analyze users’ spending behavior and generate tailored insights. This might include budget recommendations, spending alerts, or savings advice. Your app should replicate this by categorizing expenses and offering actionable tips.

- Fraud Detection and Prevention: AI algorithms detect anomalies and flag suspicious activities in real time. For instance, if a user suddenly tries to transfer a large sum to an unknown foreign account, the app can prompt for additional authentication or temporarily freeze the transaction.

- Smart Customer Support: AI-powered chatbots are available 24/7 to handle common queries like “What’s my current balance?” or “How do I change my password?” This reduces load on customer service teams and enhances user satisfaction.

- Credit Scoring and Risk Assessment: HSBC leverages AI to assess loan eligibility and creditworthiness by analyzing not just credit scores but also income flow, payment history, and financial habits.

- Predictive Analytics: Want to know when a user’s account might go overdrawn? Or, which customers are likely to upgrade to a premium account? Predictive analytics can help you preempt user needs and deliver proactive solutions.

AI isn’t a feature—it’s a long-term capability. Implementing AI requires clean data pipelines, feedback loops, and ethical governance frameworks to avoid bias. But if done right, it can completely redefine your user experience.

Blockchain and Cryptocurrency Integration

While HSBC hasn’t fully jumped into the crypto space like some neobanks, they are experimenting with blockchain in areas like trade finance and digital identity. For future-facing apps, blockchain offers enormous potential.

Here’s how it’s being integrated into modern mobile banking:

- Secure Transactions: Blockchain’s distributed ledger technology offers enhanced security and transparency. Every transaction is recorded, immutable, and verifiable.

- Smart Contracts: These are self-executing contracts coded with the terms of agreement. They can automate payments, insurance claims, or loan disbursements, removing middlemen and speeding up processes.

- Digital Identity Verification: Users can create a verified, blockchain-based digital ID that can be used for onboarding or KYC purposes. This reduces onboarding time and improves accuracy.

- Crypto Wallet Integration: Apps are now offering integrated wallets for popular cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Some even allow instant conversion between fiat and crypto.

- Decentralized Finance (DeFi): Though still in its early stages of adoption, DeFi protocols can enable users to access lending, staking, or yield farming features right from the app.

While blockchain implementation is complex and still heavily regulated, it’s clear that the future of mobile banking will be deeply influenced by decentralized technologies.

Common Mistakes to Avoid When Building a Banking App

Even with the best intentions and resources, many banking apps fail to meet user expectations. Avoiding these common pitfalls can save you time, money, and headaches:

Ignoring Compliance Requirements

Skipping or underestimating the legal side of fintech is one of the most dangerous mistakes. Regulatory fines can be devastating. Make compliance a core function from day one—hire experts, conduct audits, and stay up to date with changing laws.

Overloading with Features

Yes, your app should be powerful—but more isn’t always better. Too many features can clutter the UI, confuse users, and lead to slower performance. Focus on usability and prioritize the features your users need.

Neglecting UI/UX Simplicity

Functionality without usability is a recipe for churn. Apps that are difficult to navigate or visually overwhelming frustrate users. Keep interfaces intuitive, use visual cues smartly, and prioritize accessibility.

Underestimating Testing

Banking apps cannot afford bugs. Period. Don’t treat testing as an afterthought. From load testing to security scans, every update should pass rigorous QA protocols.

Lack of Customer Support Integration

Users expect instant answers when it comes to their money. An app without integrated support—like live chat or easy ticket creation—will quickly lose trust.

No Plan for Continuous Improvement

The fintech landscape evolves rapidly. Launching your app is just the beginning. You need to constantly collect feedback, roll out updates, and innovate based on user behavior and tech trends.

Avoiding these pitfalls means treating your app as a living, evolving product, not a one-and-done project.

Conclusion

Creating a mobile banking app like HSBC in 2025 is not just about mimicking a brand, it’s about building a secure, intuitive, and future-ready platform that your users will trust with their finances.

From laying a strong foundation with research and UI/UX design, to integrating cutting-edge tech like AI and blockchain, to navigating the complex maze of regulatory compliance, every step requires deliberate planning and execution.

But the reward? Massive. Not just in revenue or user growth, but in establishing your brand as a credible, forward-thinking player in the fintech space.So whether you’re a startup with a disruptive vision or a traditional bank ready to modernize, now’s the time to leap. The future of banking is mobile, intelligent, and user-first.